White House Conference on Aging: What You Need to Know First About Enrolling in Medicare

Reading Time: 2 MinutesLast Updated: November 6, 2023

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

A healthy life is a good life. The Medicare benefits you’ve earned ensure that you can receive the care you need, when you need it.

And, when it comes to Medicare benefits, the most important thing to remember is to apply for them at age 65.

On your behalf, advocacy groups asked us to place a greater emphasis on information about enrolling in Medicare at age 65, and specifically, about the potential problems that arise if you don’t.

In the past few months, in conjunction with the White House Conference on Aging, the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration have strengthened many of our communications products to ensure that all people nearing age 65 hear the following message:

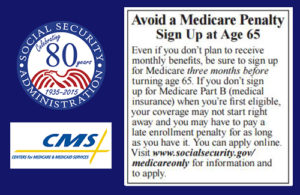

Three months before your 65th birthday, you should apply for Medicare benefits. At that time, you’ll be asked to elect if you also want Medicare Part B that helps pay for doctors’ services and many other medical services and supplies that hospital insurance doesn’t cover. If you don’t sign up at age 65, and you then decide to enroll later, you may pay a lifetime late enrollment penalty, and you may have a gap in medical insurance coverage. There are exceptions, but play it safe, and ask your Medicare or Social Security representative about your personal situation.

To make this message clear, our two agencies have already:

- Updated the text accompanying Medicare cards to emphasize the importance of enrolling in Part B when you’re first eligible, to avoid paying a penalty for as long as you have Medicare coverage.

- Updated publications about Medicare, such as the “Medicare” booklet and the “Apply Online For Medicare In Less Than 10 minutes—Even If You Are Not Ready to Retire” leaflet, to emphasize the importance of enrolling in Medicare when you’re first eligible.

- Updated frequently asked questions on Social Security’s and CMS’ websites, phone scripts, and training materials to better inform those who are newly eligible for Medicare.

- Updated the Social Security Statement and the insert for people who are 55 and older to strengthen the message about when to apply for Medicare. To get your Statement online, open a my Social Security account.

In the next few months, CMS will update their website and the Medicare initial enrollment period package; revise more Medicare publications; and add online resources for people who are still working.

Visit Medicare.gov to find out more about enrolling in Medicare. And, remember to apply online for Medicare three months before your 65th birthday!

Did you find this Information helpful?

About the Author

Comments

Comments are closed.

Maura P.

I was told I cannot cancel my Medicare without steep penalties going back to 2015 whether I had health insurance through Medicare or through a work insurance plan if I was working.

I cannot afford insurance now and afford my rent and utilities.

I make too much social security income to be eligable for Mass Health.

Is there anything I can do?

Also is this an IRS issue of a Medicare issue?

Thank you

Maura P. Lucey

Vonda V.

Hi Maura. Unfortunately, and for your security, we do not have access to your information in this venue. To inquire about your Medicare options, you will need to contact your local Social Security office or call our toll free number at 1-800-772-1213. Representatives are available to help you Monday through Friday between 7 a.m. and 7 p.m.

Clement

As guris têm bastante contato com a água. http://themakershouse.org/index.php/component/k2/item/6-maker-s-house-chapel-launches-3-books